Big Data in Finance: Benefits, Use Cases, & Examples

Subhasish Dutta

•15 min read

- AI/ML

The collapse of Lehman Brothers in September 2008 shook up the entire business world, emphasizing the importance of making data-driven decisions for businesses. Fortunately, financial organizations can now leverage the power of big data in finance to make informed decisions and avoid such situations. In fact, businesses across industries are using this technology for a wide range of purposes, including fraud detection, predictive analysis, and market research, among others.

According to a report by Statista, “The global big data analytics market is expected to see significant growth over the coming years, with a forecasted market value of over 650 billion dollars by 2029.” But what is big data, and what are its benefits and applications in the finance industry? In this article, we will deep dive into big data analytics in finance, its benefits, and use cases in the financial industry. We will also look at some real-life big data analytics applications in the financial industry.

Let's get started!

What is big data?

Big data refers to extremely large data sets that may be analyzed computationally to reveal patterns, trends, and associations, especially relating to human behavior and interactions. Big data is characterized by the high volume, velocity, and variety of information that undergoes processing and analysis. It can include structured data (like databases), unstructured data (like social media posts), and semi-structured data (like web logs). The insights derived from big data analysis can lead to better decision-making and strategic business moves.

The three Vs of big data are:

- Volume: This refers to the massive quantities of low-density, unstructured data. The volume can range from tens of terabytes to even petabytes.

- Velocity: This represents the rapid rate at which data arrives and requires processing. In big data, data flows in and gets processed at a breakneck pace.

- Variety: This indicates the diverse forms that data can take. In big data, data can appear as numbers, texts, images, audio, and videos.

Big data opens up a wealth of opportunities for businesses. It empowers companies to enhance decision-making processes, design personalized products or services, deliver superior customer service, make accurate predictions, and identify fraudulent activities.

Benefits of using big data in finance

According to a report by SNS Telecom & IT, “Big data technologies play a pivotal role in facilitating the creation and success of innovative FinTech (Financial Technology) startups, most notably in the online lending, alternative insurance, and money transfer sectors.” The benefits of big data in the finance industry are substantial, from mitigating risks and improving decision-making to optimizing operations. Here, let's look at the top benefits.

1. Improved decision-making

Big data in finance can significantly improve decision-making by providing valuable insights into market trends and customer behavior, allowing them to predict future outcomes. Big data analytics tools can extract and process a vast amount of data from various sources, including market data, customer transactions, news articles, social media, and other sources. This analysis gives businesses a comprehensive understanding of hidden trends and patterns, helping them make more informed decisions.

2. Cost reduction

Big data can automate several manual tasks, such as compliance checks, fraud detection, and risk management. Businesses can also use big data analytics to improve efficiency in various areas, such as customer service, risk management, and marketing. Moreover, big data can also help businesses reduce costs. For example, a financial institution can use big data to identify unprofitable business sections and focus on those generating more revenue and profit.

3. Enhanced customer experience

Customer preferences and needs are changing fast in this age of digital transformation. Big data is crucial in improving user experience by providing insights that enable businesses to understand their customers better, engage with them, and meet their needs. Financial institutions can offer tailored product recommendations by understanding customer preferences and making them feel valued, appreciated, and empowered. Additionally, they can use big data to segment their customers into various groups based on different criteria, such as demographics, transaction history, and behavior, and offer them personalized customer service. This personalization can lead to increased satisfaction, loyalty, and profitability.

4. Operational efficiency

Big data analysis can help businesses optimize processes by identifying areas that lack efficiency. For example, a bank can use big data to identify unprofitable branches or products and close them down. Moreover, companies can automate various tasks, such as fraud detection and customer service, and utilize employees' time to focus on more strategic tasks.

Investment firms use big data analytics to develop sophisticated trading algorithms and investment strategies. These algorithms can process vast amounts of data in real time, increasing efficiency and enabling them to make more informed and efficient trading decisions.

5. Regulatory compliance

Regulatory compliance is a critical aspect of businesses, especially in finance. Big data can help financial institutions ensure compliance by automating data collection, analysis, and reporting, reducing the risk of non-compliance and penalties. It can also help create and maintain comprehensive records of transactions, making it easier to demonstrate compliance during audits. Moreover, organizations utilize big data analytics to detect and report suspicious activities promptly, helping them remain compliant with government regulations.

6. Competitive advantage

Big data analytics allows financial institutions to make data-driven decisions, giving them a competitive edge. Companies can gain insights into market trends, customer behavior, and risk factors by analyzing vast amounts of data. Moreover, companies can use big data to identify and assess risks more effectively, leading to better investment and lending decisions and mitigating the risks.

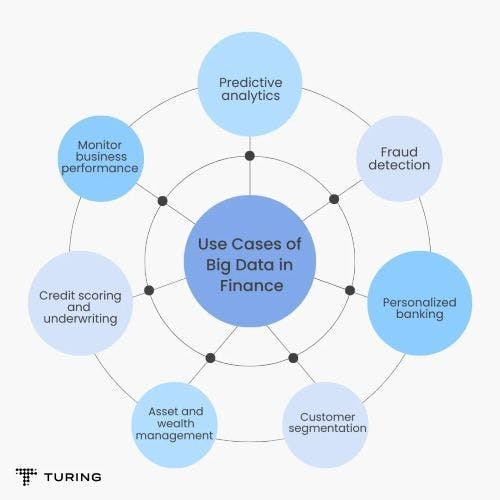

Use cases of big data in finance

The application of big data analytics in the financial industry is diverse and dynamic, ranging from predictive analysis to personalized banking and fraud detection. Here are the top seven use cases of big data.

1. Predictive analysis

Businesses today leverage big data in finance for predictive analysis since it uses historical and real-time data to forecast future trends, risks, and opportunities. Credit risk assessment is one of the primary applications of big data analytics in the financial industry. Financial institutions analyze extensive datasets, including customer transaction history and credit scores, to predict the chances of a borrower defaulting on a loan. This predictive analysis helps lenders decide when to approve or deny their loan applications.

Moreover, financial analysts can use big data to predict market trends and make investment decisions. By analyzing historical market data, economic indicators, and current trends, predictive models can provide valuable insights into asset price movements and market direction, helping investors make informed decisions.

2. Fraud detection

Fraud is a massive challenge to the financial world, costing businesses and consumers billions of dollars annually. According to a CNBC report, fraudulent activities cost consumers $8.8 billion in 2022, up by 44% compared to 2021. Traditional methods of fraud detection are not very effective in detecting fraud. However, the emergence of big data has revolutionized how financial institutions combat fraudulent activities.

Big data analytics allow financial institutions to collect and store every transaction, providing a comprehensive dataset for analysis. By analyzing transaction patterns, they can use big data technology to detect fraudulent activities such as money laundering or identity theft. Moreover, big data uses machine learning algorithms to analyze historical data and identify fraudulent patterns and unusual behaviors, such as unusual spending patterns or transaction locations that may indicate fraud.

3. Customer segmentation

Segmenting customers based on their behavior and preferences allows financial institutions to proactively address the needs of different customer groups, helping them retain customers and reducing churn rate. Big data analytics is pivotal in segmenting customers based on their financial behavior and preferences. For example, a bank might want to segment its customers based on their income level, location, or risk profiles.

Big data can help businesses distinguish customers in different groups. By analyzing large volumes of transaction data, companies can categorize customers into distinct segments and use them to offer personalized services and product recommendations for each group.

4. Personalized banking

Offering personalized banking is critical for financial institutions as it improves customer satisfaction and loyalty by tailoring financial services to individual needs and preferences. Applying big data in finance enables banks and other financial institutions to assess a customer's needs more comprehensively by analyzing transaction history, social media activity, and economic trends. This allows banks to offer tailored lending solutions, insurance policies, and investment options that align with their customers' requirements and risk tolerance.

5. Asset and wealth management

Big data analytics offers a wealth of benefits to financial institutions in asset and wealth management. It enhances decision-making by providing insights into market trends and customer behavior while bolstering risk management through predictive analysis. The ability to analyze individual client data enables the provision of personalized services and investment advice.

Furthermore, big data can detect fraudulent activities by identifying unusual patterns in large datasets. Lastly, it boosts operational efficiency by automating data analysis processes, leading to cost reductions and improved service delivery.

6. Credit scoring and underwriting

Credit scoring and underwriting are critical processes for a financial institution as it helps to evaluate a loan application and determine whether to approve it or not. The application of big data in finance has significantly improved credit scoring and underwriting.

Banks and other lending institutions can reduce bias and make better lending decisions by incorporating predictive models and analyzing a broader range of data sources. This helps improve risk management by lenders and considerably reduces the loan default rate. Additionally, using the insights gained from big data, lenders can customize loan and credit card offers according to individual needs.

7. Monitor business performance

Businesses can use big data to track financial metrics such as revenue, expenses, profits, and others. By analyzing the vast and diverse datasets, financial institutions can gain deeper insights into their operational performances and optimize their strategies accordingly.

Big data also allows businesses to compare performance against competitors and industry benchmarks. This helps in setting realistic goals and building strategies to achieve them.

What are the big data challenges facing the banking and finance industry?

Big data is a powerful tool for financial institutions looking to improve their operations and customer experiences. However, it also presents a number of challenges, including:

- Data security & privacy: The financial industry is a prime target for cyberattacks. Protecting sensitive customer and financial data from breaches requires strict control over how data is collected, stored, and shared. So, maintaining the right balance between data analytics and privacy is essential to ensure data security and privacy.

- Meeting regulatory compliance: Financial institutions must comply with data privacy laws and regulations, and managing big data while complying with these regulations can be challenging. They must store, process, and report data in accordance with the regulatory requirements.

- Data silos: Banks and other financial institutions have large amounts of data stored in different systems, making it difficult to access and analyze. This can lead to incomplete and inconsistent data, which is a major challenge in big data analytics.

7 Real-world examples of financial institutions using big data

Banks and other financial institutions worldwide are leveraging the power of big data analytics to gain deeper insights, manage risks, enhance customer experiences, and streamline their operations. Let’s look at seven real-world examples of top financial services companies using big data analytics in finance.

1. JP Morgan & Chase (Understand consumer behavior)

JPMorgan offers various financial services, including private banking, commercial banking, investment banking, asset management, and others in more than 100 countries. The bank offers services to individuals, businesses, and other financial institutions.

The analytics systems at JPMorgan use customers' transactions data and combine them with other data sources to draw better insights and get a clear perspective of which customers are credit-worthy and prospective buyers of financial products or services. The investment banking behemoth uses big data technology to crunch massive amounts of data to detect patterns in customer behavior, helping the bank identify market risks and possible opportunities to make money.

JPMorgan utilizes predictive analytics to help its customers manage their working capital and cash forecasting needs. The bank's forecasting services leverage predictive analytics to determine alterations in limits and credit lines to optimize cash balances.

The bank also leverages big data to read the US Economy. The JP Morgan Institute analyzed the income and spending habits of about 2.5m account holders for more than two years between 2012 and 2014 to find the earning and spending patterns.

The report revealed the income of two in five individuals varies by at least 30% from one month to another. The report provided policymakers with all the data and tools to revive the struggling US economy and improve the lives of Americans.

2. Goldman Sachs

Goldman Sach is a US-based leading global investment banking and financial services institution. The company has been at the forefront of leveraging big data in finance to find better investment opportunities, gain a competitive edge, and provide better client services.

The bank strongly focuses on creating data-driven investment models that evaluate thousands of companies globally to find the right investing opportunities. Analyzing large datasets, including financial statements and market data like prices, returns, etc., helps the firm identify strong businesses with attractive valuations and make the right investing decisions.

In a recent report, Takashi Suwabe, a senior portfolio manager at Goldman Sachs Asset Management, said that computers could only analyze organized or easily quantifiable data in the past. However, with the inception of big data technologies, they can also analyze unstructured data. These innovations enable them to interpret data from different formats, including images and speech.

Machine learning techniques help them create dynamic models that adapt to different data formats, allowing them to import data from various sources. This data processing method allows the banking giant to cover more companies than traditional methods.

3. American Express

American Express is an American financial services company that offers credit, charge cards, and insurance services to individuals and businesses. The firm operates in more than 110 countries across the globe. The company utilizes big data in finance to enhance its fraud detection and prevention capabilities.

Analyzing the vast amounts collected from cardholders and merchants, the credit card giant makes fraud assessments in fractions of a second. They ensure a hassle-free purchasing experience for legitimate customers while limiting fraudulent transactions. This data includes purchase history, monthly spending, location data, and more. By processing this data, they comprehensively view the cardholder's spending behavior.

Data scientists at American Express have created a tool called Enhanced Authorization (EA), allowing American Express and merchants to identify who is behind the transaction. During any transaction, the merchant sends additional information such as email address, IP address, and shipping address.

Amex cross-checks the information with the one stored in its database, helping them prevent fraud. According to a Harvard School of Business digital initiative report, American Express has been able to reduce fraudulent transactions by 60% using EA.

4. BlackRock

BlackRock is one of the world's leading asset management firms that harnesses the power of big data to develop more effective asset management strategies. This innovative approach helps BlackRock find better investment opportunities, enhance portfolio performance, make informed decisions, and deliver value to its clients.

The investment management company uses big data in finance to analyze vast amounts of financial data, economic indicators, and market trends. This helps them gain insights into potential investment opportunities and risks. Utilizing data-driven strategies allows BlackRock to make informed investment decisions and optimize portfolio performance.

The asset management firm uses big data to run comprehensive diagnostics on thousands of stocks worldwide to find better investment opportunities to deliver high returns while minimizing the risks. The company uses sophisticated ML models to assess and manage inherent risks in various asset classes. By constantly monitoring data related to market volatility, credit risk, and macroeconomic factors, they adjust portfolios in real time to mitigate potential losses.

5. Wells Fargo & Company

Wells Fargo & Company is a US-based financial services company that offers retail, wholesale banking, and wealth management services to individuals, businesses, and institutions. The company operates in over countries with more than 70+ million customers across the globe.

The bank has embraced big data analytics to optimize business operations, make data-driven decisions, and provide better client services. To execute its data analytics process, the company has built a Tableau-powered team that collects, combines, cleans, and categorizes data from 70 million customers.

According to an Express Computer report, Prahalad Thota, Head of Enterprise Analytics & Data Science at Wells Fargo & Company, mentioned that they use big data to organize large volumes of data collected from different resources and bring them into one place for analysis. He added that since 2017, they have been using the latest technologies from big data environments to compile and analyze data.

This has helped them in customer segmentation, personalization, and risk management in a better way, resulting in improved customer experience and better revenue generation.

6. Morgan Stanley

Morgan Stanley, an American multinational investment and wealth management bank, utilizes big data technology to optimize its portfolio analysis, improve its financial operations, and offer better services to its clients. The company has invested a whopping approximate amount of $2.7 billion in 2021 in the latest technologies, including AI, ML, big data, and others.

The banking stalwart collects massive amounts of data from various sources, including customer data, market data, economic data, news articles, social media posts, and others. Utilizing big data, they extract insights, trends, and hidden patterns to help financial advisors and clients make the right investment decisions to achieve their financial goals.

Besides that, Morgan Stanley uses big data, AI, and ML to comprehensively understand market dynamics and risk factors. This data-driven approach helps them make well-informed investment decisions and optimize portfolio performance while managing potential risks effectively.

Morgan Stanley also leverages big data and AI/ML for fraud detection. In a conversation with Times of India in 2022, Katherine Wetmur, Co-CTO at Morgan Stanley, said that they use AI/ML to predict fraudulent events and send alerts. The company added more information to ensure their operations staff could do more triaging and reduce the response time.

Although Morgan Stanley is a financial services firm, it understands the importance of data and how to use it to improve their services to generate more revenue across different departments within the organization.

7. Societe Generale

Societe Generale is a leading bank in France that was established more than 150 years ago. The investment banking farm supports 25 million clients in 66 countries. The financial services company has been focusing on becoming more data-driven, using technologies like big data, AI, and ML to benefit its customers, regulators, and staff. They aim to use data to make existing business models more efficient while finding new opportunities.

The company has been investing in big data and AI since 2014, as it has been a key component of its digital transformation. With over 1,000 data experts working across geographies, the bank uses big data to make data-driven investment decisions and monitor risk exposures in real-time. This approach helps them reduce uncertainties and enhance portfolio performance.

Understanding clients' needs is at the core of Societe Generale's strategy. By implementing big data analytics, the bank gains insights into client behavior and preferences and offers tailored financial products and services that meet individual requirements and more value for their customers.

According to a Societe Generale report, as of 2022, “The group’s portfolio has about 340 Data and AI use cases working to best apply our strategy with an expected value creation of €500 million.” The company aims to accelerate the utilization of data and AI to benefit its 25 million customers worldwide.

Conclusion

Big data has completely transformed the finance industry. The sophisticated analytical methods and machine learning algorithms help companies uncover hidden trends and patterns that facilitate quick and accurate decision-making. Banks and other financial institutions are using big data to improve their operational performance, make better decisions, and provide more personalized services to their customers.

As big data technology develops, financial institutions can build innovative products and services that will cater to the evolving needs of consumers and investors. However, companies need to partner with the right big data solution provider to harness its full benefits. That’s where Turing can help.

Turing’s industry experts specialize in providing tailored big data services for the finance sector. By partnering with Turing, organizations can unlock big data's full potential, optimize operations, enhance risk management, and make informed decisions. Partner with Turing and join 900+ Fortune 500 companies and emerging startups that have leveraged Turing for their engineering needs.

Want to accelerate your business with AI?

Talk to one of our solutions architects and get a complimentary GenAI advisory session.

Get Started

Author

Subhasish Dutta

Subhasish is a science graduate but a passionate writer, and wordsmith who writes website content, blogs, articles, and social media content on technologies, equity market, traveling, and other domains. He has worked with Affnosys and FTI Technologies as a content writer.

Share this post

Want to accelerate your business with AI?

Talk to one of our solutions architects and get a complimentary GenAI advisory session.

Get Started