Algorithmic Trading With Python and How to Use the FXCM Broker

•5 min read

- Languages, frameworks, tools, and trends

- Skills, interviews, and jobs

Technology has become a valuable asset in the finance industry as more enterprises and financial institutions employ it. Among the widely used programming languages in fintech, Python is gaining massive popularity. Algorithmic trading with Python is disrupting the fintech sector with its ability to predict and forecast the different price points in trading.

This article will shed light on how to effectively implement algorithmic trading with Python using the FXCM broker platform.

What is algorithmic trading?

Algorithmic or quantitative trading deals with developing mathematical and statistical strategies. It is an extremely complex domain in the fintech market.

Algorithmic trading with Python enables traders to use computer codes and leverage technology to open and close trades. This method of trading also helps in analyzing the different price points in an underlying market.

Once market conditions match the predetermined criteria, trading algorithms help traders to execute a buy or sell order on their behalf. This approach automatically scans the market and saves time.

Different types of algorithmic trading strategies

Algorithmic trading strategies require an identified opportunity that is profitable in terms of cost reductions and improved earnings. Here are a few strategies used in quantitative trading:

1. Trend-following strategies

Following trends in algorithmic trading is the most commonly used strategy. Aspects such as channel breakouts, moving averages, price level movements and other related technical indicators are a few trends traders follow. As these trends do not require making any price forecasts or predictions, they are the easiest to implement through algorithmic trading. The 50-200 day moving average is a popular trend-following strategy.

2. Arbitrage opportunities

Arbitrage or profit generally deals with buying a dual-listed stock at a lower price in one market and selling it at a higher price in another market. Price differentials exist from time to time and traders replicate this strategy for stocks. Implementing an algorithm to identify price differentials offers profitable opportunities.

3. Index fund rebalancing

Index funds are redefining periods of rebalancing to bring their holdings with their respective benchmarks indices. This is one of the widely used algorithmic trading strategies. Here, traders capitalize on the expected trades that offer 30-80 basis profit points depending on the number of stocks in the index fund rebalancing.

4. Mathematical strategies

Strategies like the delta-neutral trading strategy allow trading on a combination of options and security. It consists of several positions with offsetting positive and negative ratios. Apart from this, it also compares the price change of assets.

5. Mean reversion

The mean reversion strategy is based on the concept of the high and low prices of an asset. Identifying and defining a price range and implementing an algorithm allows traders to automatically place trades when the price of an asset fluctuates out of its defined range.

6. VWAP

Volume weighted average price (VWAP) strategy fragments a large order and dynamically releases the order fragments to the market using stock-specific historical volume profiles. This strategy helps in executing the order close to the volume-weighted average price of an asset.

7. TWAP

Like the VWAP strategy, the time weighted average pricing (TWAP) strategy helps break up large chunks of orders to the market using evenly divided time slots between the start and end time. TWAP automatically executes the order close to the average price between the start and end times and minimizes the market impact.

8. Implementation shortfall

The implementation shortfall strategy aims to minimize the execution cost of an order by trading off the real-time market. Implementation shortfall increases the targeted participation rate when the stock price moves favorably and decreases it when the prices move adversely.

What is FXCM broker?

FXCM is a leading platform for contract for difference (CFD) trading, foreign exchange, spread betting, and other related services. Also known as Forex Capital Markets, FXCM is a retail forex broker for trading on the foreign exchange market. The platform enables traders to speculate on the foreign exchange market and also provides CFDs on major indices.

FXCM broker offers access to the liquid market by providing traders with innovative tools, high-performance trading educators, and the best online trading experience. Apart from this, it offers one-click execution and mobile trading from real-time charts.

FXCM APIs

An API helps build application software. It is a set of predefined methods of communication between various software components. FXCM offers four free APIs:

- REST API

- FIX API

- Java API

- ForexConnect API

Each of these connects directly to the FXCM trading server.

- REST API

Representational state transfer API is a web-based API that uses a WebSocket connection developed keeping algorithmic trading in mind. Developers can build customized trading software and integrate them into the FXCM broker platform.

FXCM utilizes OAuth 2.0 for authentication through a token. This enhances the security of your application and can be easily integrated with hybrid applications. Using the socket.io library, the API streams and pushes the data in the JSON format.

- FIX API

Financial Information eXchange or FIX API is a FIX protocol standard designed for a real-time custom interface that pushes up to 250 price updates per second.

- Java API

Java API is a wrapper SDK of the FIX API that offers a fully functioning and customizable API into the FXCM trading platform. It is light, scalable, and compatible with any operating system that is Java-compliant.

- ForexConnect API

The ForexConnect API offers all the functionalities including position management, live price streaming, order management, historical instrument rates download, and account report fetching.

Implementing algorithmic trading with FXCM broker

The FXCM broker platform offers multiple APIs but the REST API has a strong use case. Python developers leverage fxcmpy (a powerful Python package) that exposes all the capabilities of the REST API through different Python classes. These classes allow for a more convenient Pythonic way to interact with the REST API on a high level.

Data scientists, Python experts, and developers seeking forex and DFC Python wrappers can easily leverage fxcmpy in algorithmic trading strategies.

Below are the steps to implement algorithmic trading with FXCM broker:

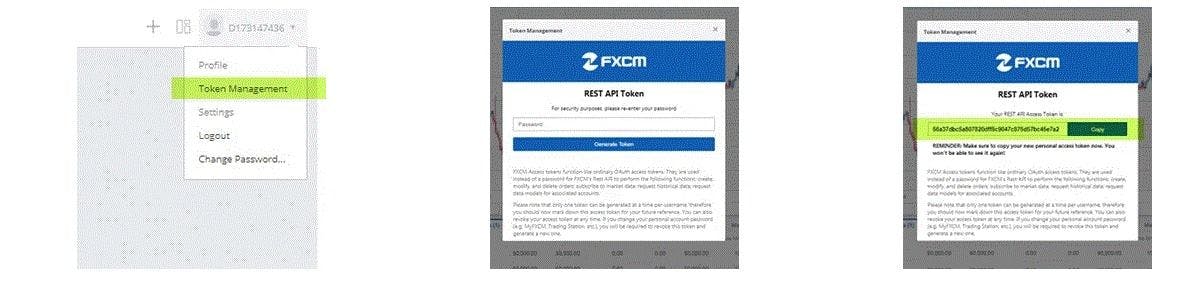

- Create your free API token by logging here.

- Create your new practice account for free.

- Create your token by navigating to the upper-hand area of the FXCM platform and selecting the ‘Token Management’ button.

fxcmpy documentation:

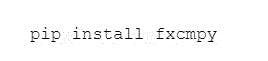

Installing the FXCM Python package is easy with pip:

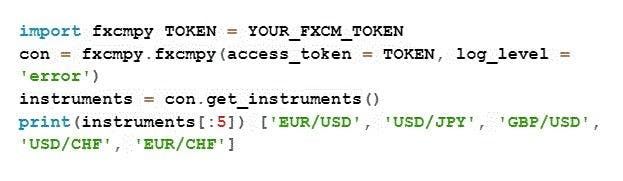

Connecting to the server using the API token:

Using the variable to reference the API token:

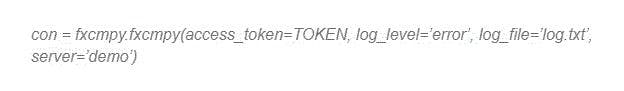

Connecting to the server and boiling down the code:

Image source: FXCM

Python is the language of the future and has strong potential in the fintech market. Use the different strategies mentioned here in your next project with other trading platforms in order to maximize algorithmic trading.